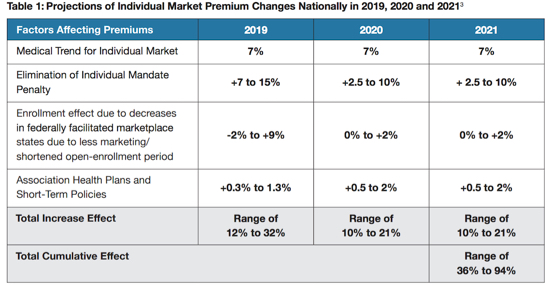

Health-care premium increases in individual markets could be as high as 32 percent in 2019 and rise between 35 and 94 percent by 2021, according to a study backed by Covered California.

“The prospect of 30 percent premium increases in 2019 and hikes of over 90 percent over the next three years threatens access to coverage for millions of Americans,” Covered California chief Peter Lee said.

“The prospect of 30 percent premium increases in 2019 and hikes of over 90 percent over the next three years threatens access to coverage for millions of Americans,” Covered California chief Peter Lee said.

The report, “Major Indicators of Individual Market Stability Highlight High Premium Increases for States in Coming Years,” looks at state-by-state impacts of federal policies under the Trump administration. President Trump has turned from an all-out repeal and replace of the Affordable Care Act and is now chipping away at the health-care law’s functions.

The analysis uses key indicators of marketplace stability to determine which states are likely to experience “catastrophic” rate changes.

States in that category include Michigan, Alabama, New Jersey and Wisconsin.

California faces “significant” increases of up to 35 percent over the three-year period. State-based marketplaces fared better in the projections than those relying on the embattled federal Obamacare operation.

The report indicates every state is at risk of cumulative premium increases of at least 35 percent in the years 2019-2021.

Subsidized consumers could be insulated from these increases because the would increase the amount of financial assistance they receive. Unsubsidized consumers would bear the full weight of the higher premiums, however.

“Lower-income Americans will be largely shielded from these price hikes, but the real-world consequence for middle-class Americans who do not receive any financial assistance in the form of tax credits is that many will be priced out of having health insurance,” Lee said.

The report points the finger at several federal policy moves, including the elimination of the so-called Individual Mandate in 2019 and the slashing of marketing funding for Obamacare programs.

Among the report’s suggestions is an analysis of the positive impact that a federal reinsurance program could have in 2019 if implemented soon.

Meanwhile, another report suggests that elimination of the federal health-insurance requirement will result in 18 percent of those in California’s individual market going without insurance. That is based on responses for the 2017 year. “Enrollees with the lowest levels of predicted medical spending were more likely to say they would not have purchased insurance in 2017 in the absence of the penalty, compared with those at higher levels of predicted spending,” the Harvard Medical School analysis said. Due to elimination of the mandate penalty, premiums would increase by an additional 7 percent in California, the report said.

> Read the Covered California health-care premiums report

Speak Your Mind